info@thelincolnclub.org

We received this info from our Congressman, Paul Cook

MYTH ~ "THE TAX PLAN ELIMINATES THE MORTGAGE INTEREST DEDUCTION-WHICH MAKES THE DREAM OF OWNING A HOME MORE DIFFICULT."

FACTS ~

The Tax Cuts and Jobs Act protects the Mortgage Interest Deduction for existing mortgages in full. After January 1, 2018, new mortgages will be protected up to $750,000. Additionally, homeowners will continue to be eligible for property tax deductions up to $10,000.

MORE FACTS ~ Americans will keep more of their own money under this tax plan, which makes it easier to afford the costs associated with homeownership. The Joint Committee on Taxation and the Tax Foundation estimate 91 percent of taxpayers in our district will receive more money back on their taxes just by way of increasing the standard deduction and lowering their taxable income.

MYTH ~ "CHANGING THE STATE AND LOCAL TAX (SALT) DEDUCTION WILL RAISE TAXES SIGNIFICANTLY ON MIDDLE-CLASS FAMILIES.

FACTS ~

Most middle-class families file their taxes using the standard deduction, which means they cannot take advantage of the SALT deduction. In fact, 70 percent of the taxpayers in our district take the standard deduction and will see significant savings from its doubling. For those that do itemize, the Tax Cuts and Jobs Act continues to allow up to $10,000 in state and local taxes, including property, income and sales taxes, to be deducted.

MORE FACTS ~ Eligible middle-class families will see a $1,000 increase (The credit is currently set at $1,000 and will rise to $2,000 per child) in the Child Tax Credit under the provisions of the Tax Cuts and Jobs Act. This allows families to reduce the amount they owe in taxes by $2,000 for each child in the household.

MYTH ~ "THIS BILL RAISES TAXES ON THE POOR AND MIDDLE CLASS."

FACTS ~

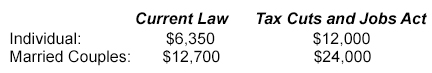

The Tax Cuts and Jobs Act delivers crucial tax relief for middle-class and low-income Americans, primarily by doubling the size of the "standard deduction." That means more of your paycheck will be protected from taxes, allowing you to keep more of your hard-earned money.

The Tax Cuts and Jobs Act also improves tax benefits that help low-income workers and families, including the Earned Income Tax Credit (EITC), a larger Child Tax Credit, and the Child & Dependent Care Tax Credit.

MORE FACTS ~ The Tax Cuts and Jobs Act maintains the following deductions: mortgage interest, higher education tuition, interest on student loans, medical expenses, and charitable contributions.

MYTH ~ "THIS BILL IS A GIVEAWAY FOR CORPORATIONS."

FACTS ~

High tax rates make American businesses uncompetitive in the global marketplace. Business Roundtable noted that our current corporate tax rate is "14 percentage points above the developed country average of 24.6 percent," and it has led to a reduction in the number of U.S.-headquartered companies. A high business tax rate means fewer American jobs are available to working class families.

The Tax Cuts and Jobs Act gives American companies a level playing field on the world stage and incentivizes them to hire new workers in the U.S.

EXAMPLES ~ Calculated Saving

Income: $28,000/year

Under current tax law: $1,234/refund received

Under new tax plan: $2,071/refund received

Tax savings: $837

Income: $39,000/year

Under current tax law: $3,823/taxes owed

Under new tax plan: $3,049/taxes owed

Tax savings: $774

Income: $62,000/year

Home mortgage: $219,000 (district median)

Under current tax law: $2,032/taxes owed

Under new tax plan: $179/taxes owed

Tax savings: $1,853

Income: $48,000/year

Home mortgage: $150,000

Under current tax law: $3,147/taxes owed

Under new tax plan: $2,499/taxes owed

Tax savings: $648

These numbers are calculated based on current IRS tax rate tables and tax rate tables found in HR 1